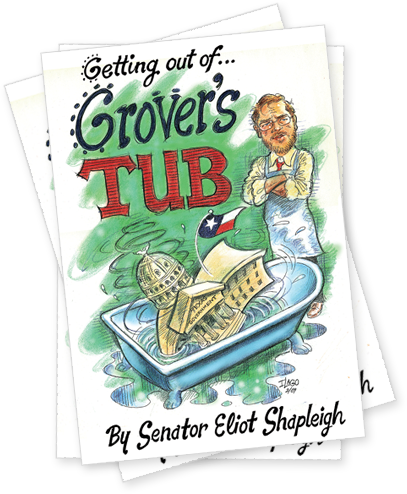

Getting Out of Grover's Tub

Chapter 4: Insuring Greed

In earlier chapters,"I described Grover Norquist’s three-pronged attack on basic American values: tax cuts for the very wealthy; budget cuts that hurt hard-working American families; and starving government to the point where it is doomed to fail.

Why is Norquist important? Grover’s philosophy has now had its way with Texas for more than two decades. At the state level, four senators and 34 House members have signed on to Grover’s pledge. At the federal level, 19 Texas Congressmen and both U.S. senators have committed to the drown. And every day, Grover’s disciples, including Rick Perry, put Texas deeper into Grover’s tub by trying to privatize schools with vouchers, sell off highways with Cintra and park the lottery with Phil Gramm.

Norquist’s philosophy is embodied by hostility toward responsible government, marked by outright contempt for the functions of government, and the belief that no regulation is the best regulation.

Deregulation offers a prime example of the flaws in this philosophy. Norquist’s followers argue that government is always the problem and never the solution; therefore, any attempt to regulate government is wrong. As Nobel Prize-winning economist Paul Krugman puts it, “If a problem can’t be solved with deregulation and tax cuts, then they pretend it does not exist.”

Let’s look at what has happened with homeowner’s insurance in Texas. In 2003, the Legislature passed industry-driven “reforms,” S.B. 14, in the hopes of balancing the insurance marketplace in Texas and stabilizing homeowner insurance rates. The industry assured lawmakers that lessening rate regulation and allowing “file and use” instead of prior approved rates, would stimulate competition and lower premiums for Texans. Governor Rick Perry had this to say when he signed the bill: “This comprehensive reform measure will stabilize the home and auto insurance market, rid the insurance industry of fraudulent practices and ensure Texans have access to fair rates offered in a competitive market. For some Texans that will mean significant rate discounts.”

What really happened? Six years after S.B. 14, Texans still pay the nation’s highest homeowner premiums, on average $1,372, almost twice the national average of $764, while profits for insurance companies continue to rise. In fact while we pay only 3.5 percent less in premiums, we get half the coverage we did in 2003. Deregulation also failed to deliver on another promise—more choices for consumers. The fact is that the number of insurers grew only three percent since 2003.

While insurance loss ratios have plummeted from 108 percent in 2002 to 36.5 percent today, insurance industry profits have risen approximately 25 percent since 2003.

During the 81st Legislative Session, Texas missed a major opportunity to bring back sensible regulation to the market. Several amendments were offered to the Texas Department of Insurance (TDI) bill, S.B. 1007, only to be tabled on straight party line votes. Among the amendments defeated included electing the Insurance Commissioner to bring more accountability to the position, prohibiting credit scoring, providing for a standardized, plain English and user-friendly insurance forms, and prior approval of insurance rates by the Commissioner.

In the energy market, we’ve seen the same results.

Before the Legislature eliminated most of the state’s electric regulations six years ago, Texas was home to some of the cheapest power rates in the country. The argument then was that rollicking competition would drive prices even lower. Today, the cost of electricity is among the highest in the nation, with monthly bills pushing past $600. On one particularly hot day in May this past summer, wholesale prices rose to more than $4 a kilowatt hour—a staggering 40 times the national average.

By the end of this summer, we could end up paying twice as much as 2008.

At the Alcoa plant 60 miles north of Austin, during 2008, the company paid four times more than its standard electricity rate to keep operating—but laid off 250 people and halved output to make budgets balance. “We have no choice but to idle production that is reliant on uncompetitive power,” said Alcoa’s president.

Put bluntly—during the Norquist era, government in Texas is failing. Deregulation has proven a model of government by and for corporate profits, not the public good.

What can you do? If you want a government that works for you, that puts the public good of its citizens before the private profit of corporations, get involved. Read the Sunset report on the Texas Department of Insurance.

Call your representatives in Austin and demand the facts. Get online and find out how your Senator or State Representative voted on key bills; let them know how it has affected your livelihood and your pocketbook.

Demand that your government work for you.