Tennessee's Tax on Illegal Drugs Nets $3.5 Million

January 4, 2007

Tennessee has collected nearly $3.5 million since it began enforcing its tax on illegal drugs two years ago, officials from the Department of Revenue said Wednesday.

Written by Brenda Goodman, New York Times

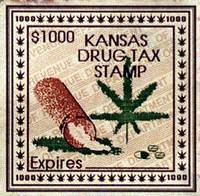

The Kansas drug tax stamp.

Tennessee has collected nearly $3.5 million since it began enforcing its tax on illegal drugs two years ago, officials from the Department of Revenue said Wednesday.

The state's Unauthorized Substances Tax, passed by the Legislature in 2004, requires anyone in possession of an illegal drug to buy and affix stamps to the drugs' packaging.

Under the law, information provided to the Department of Revenue to buy stamps cannot be used in criminal prosecutions. There is a toll-free number for stamp application requests, and stamps are doled out based on type of drug and weight.

As is the case in some two dozen other states with similar laws, however, the stamps have become curiosities bought by collectors and lobbyists who campaigned for the bill.

Of the 726 stamps sold so far, none have turned up on seized drugs, said Loren Chumley, commissioner of revenue for the State of Tennessee.

While many think that the idea is inspired, others object to it.

''It's almost like the law wasn't written to be construed seriously,'' said Gregory P. Isaacs, a lawyer in Knoxville. ''It's like asking for someone to get a special permit before they drive drunk.''

The real money the law generates comes from penalties assessed on people caught with unstamped drugs. Fines may equal up to 10 times the amount of the tax, and are vigorously collected, Mr. Isaacs said.

Because the taxes can be collected based on a preponderance of evidence, rather than a determination of guilt, defense lawyers are challenging the law, saying it violates the guarantee against double jeopardy and the right to due process.

In one case in July, an appellate court ruled that the law was unconstitutional. That decision is being appealed to the Tennessee Supreme Court.

![]()

![]()

Related Stories

![]()

Fair Use Notice

This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a "fair use" of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml. If you wish to use copyrighted material from this site for purposes of your own that go beyond "fair use", you must obtain permission from the copyright owner.