What matters more? Tax cuts for wealthy donors or truly educating our children?

April 13, 2006

Last spring, Senator Shapleigh led the Senate fight against a proposed tax plan that would have raised taxes on 9 in 10 Texans.

Written by Senator Eliot Shapleigh, www.shapleigh.org

EL PASO - Last spring, Senator Shapleigh led the Senate fight against a proposed tax plan that would have raised taxes on 9 in 10 Texans. After reviewing the "new" Perry proposal, he resolves to continue that fight.

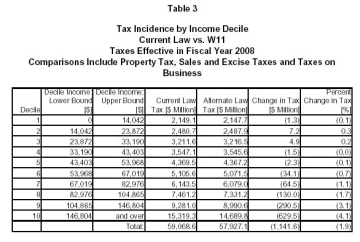

"Under the Perry plan, the total tax relief to all Texans who make less than $54,000 is zero. In El Paso, that is two in three families", said Senator Shapleigh. "In fact," he continued, "those Texas families pay net $7 million more in taxes. For Texans who make more than $100,000, the tax cuts total $920 million." The chart below , which outlines the distribution of tax cuts under the Governor's plan, illustrates its regressivity.

"Like all tax proposals of the last seven sessions, Perry's plan is another 'Great Texas Tax Shift'. Middle-class Texans pay more and the very wealthy pay less. Moreover, as the very wealthy Texans watch their taxes shift down, their incomes are shifting up."

"In fact, the gap between the rich and the rest of us is unlike any other state in the nation. In the early 2000s, Texas had the greatest income inequality between the top 20 percent of income earners and the middle 20 percent. So, in Texas, while the very wealthiest Texans saw the greatest income increases, they also received the greatest cuts in taxes", said Shapleigh.

The tax and income shift in Texas mirrors the tax shift across the nation.

• Nationally, Americans with annual incomes of $1 million or more, about one-tenth of one percent of all taxpayers, reaped 43 percent of the savings created by recent tax changes, according to Citizens for Tax Justice.

• In 2005, the middle class, or those families in the 40 to 60 percent range of U.S. incomes, saw an average combined tax cut of $742, increasing their after-tax income by 2.6 percent. The top one percent, however, will receive an average combined tax cut of $34,900, boosting after-tax income by 4.6 percent.

• Two more federal tax cuts just kicked in on January 1, 2006, 97 percent of which will go to households with incomes of over $200,000.

As it is in DC, so it will be in Texas. The richest Texans, who do not have to pay state taxes on personal incomes and no longer have to pay any sort of state tax on their estates, will see their property taxes greatly reduced.

"What is more troubling than just an income and tax shift is that Texas' children, and Texas' future, are being held hostage. Texas ranks 50th among the states for high school graduation rates and 48th in country in SAT scores , and Texas pupil expenditure recently dropped from 35th to 38th in the nation ; yet, despite the obvious failures, we continue to shortchange our schools. Governor Perry has essentially said that until his plan that raises middle class taxes is adopted, addressing dropout rates and SAT scores is not an option. If Texas' leadership does not meet the challenges of educating our children, for the first time in Texas history, we face a future less prosperous than today", said Shapleigh.

"Texans want us to educate our children not pass more tax cuts to the wealthiest Texans."