From the Senator's Desk . . .

January 14, 2010

"Why Texas Needs Health Reform More than Any State in the U.S."

Unless our community supports President Obama now, reform will not happen in our lifetimes. Over the last decade, Texas leaders have failed our state. Governor Rick Perry and U.S. Senators Kay Bailey Hutchinson and John Cornyn have all had a decade to fix Texas' broken health care system. During the last ten years, Perry’s approach has been to kick over 230,000 kids out of the Children's Health Insurance Program, 500,000 out of Medicaid, call it victory, then vacation with Grover Norquist.

Written by Senator Eliot Shapleigh, www.shapleigh.org

Why Texas Needs Health Reform More than Any State in the U.S.

Unless our community supports President Obama now, reform will not happen in our lifetimes. Over the last decade, Texas leaders have failed our state. Governor Rick Perry and U.S. Senators Kay Bailey Hutchinson and John Cornyn have all had a decade to fix Texas' broken health care system. During the last ten years, Perry’s approach has been to kick over 230,000 kids out of the Children's Health Insurance Program, 500,000 out of Medicaid, call it victory, then vacation with Grover Norquist. During his tenure as governor, health insurance premiums have increased 91.6 percent. In the state with the highest percentage of uninsured in the U.S., Cornyn brags, "[w]e have created greater access to quality health care in Texas… [s]o, you have to understand what I mean when I say I want to make Washington, D.C., and the rest of our country more like Texas [because], frankly, we know the policies that actually work." Hutchinson chooses to fawn over donors whose taxes might be raised with meaningless, late hour amendments to bills long overdue, and ignores written requests to pass a health agenda.

Over the years, in public schools, mental health, harmful air emissions, civil rights, prisons, and even Medicaid, we have discovered that if the federal government will not lead positive change in Texas, then it will not happen. So, please, don’t fail us again—do what a decade of failed Texas leaders have not done—let's get everyday Texans basic health care at an affordable cost.

A significant number of Americans do not have health insurance. In 2008, 46.3 million Americans—about one in six—were uninsured. 7.3 million were children without health insurance.

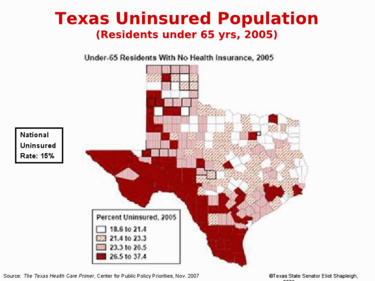

Texas is now "the ground zero of health care" in America. Texas has more uninsured than any state in the country. One out of four Texans—more than six million—does not have health insurance.

Click here to view larger image.

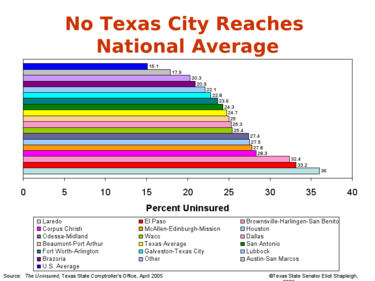

Not a single Texas city meets the national average in citizens covered with insurance—not Austin, not Dallas, not Houston. In fact, El Paso has more insured by percentage than any large city in the U.S. today.

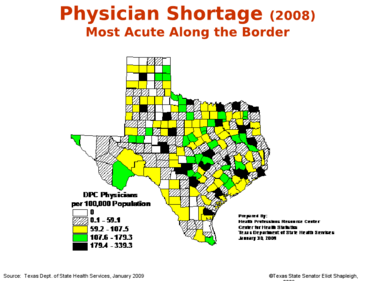

Lower numbers of those with health insurance results in fewer doctors, nurses and other health care professionals available to Texans. While the national average for physicians per 100,000 is 214, Texas has only 159. Massachusetts has 303; New York has 263; Pennsylvania has 237; Florida has 222; Montana has 217; Alaska has 216; Virginia has 215; Michigan has 214; California and Ohio have 210; Illinois has 208; Kentucky has 190; Georgia has 185.

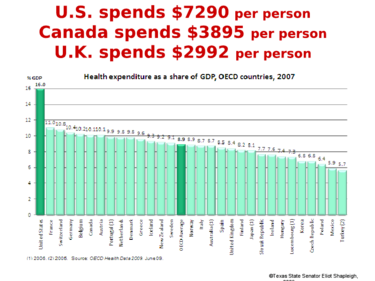

The U.S. spends far more money per capita on health care than any other developed country—16 percent of our Gross Domestic Product versus 10.1 percent for Canada and 8.4 percent for the United Kingdom (U.K.). In 2007, we spent $2.2 trillion on health care or $7,290 per person versus Canada's $3,895 per person and the U.K.'s $2,992 per person. Despite these enormous expenditures, the U.S. ranks far worse on numerous health quality indicators, including life expectancy, infant mortality, and heart disease mortality. Japan, Sweden, France, Germany, Italy, Denmark, Australia, Canada and the U.K. all have better health outcomes. In fact, our infant mortality rate is about that of Croatia and Estonia. Moreover, the U.S. has fewer physicians per capita than most other developed countries. In 2007, the U.S. had 2.43 physicians per 1,000 population while the OECD average was 3.1.

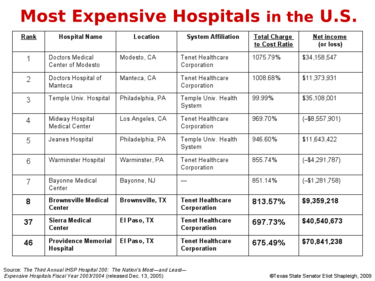

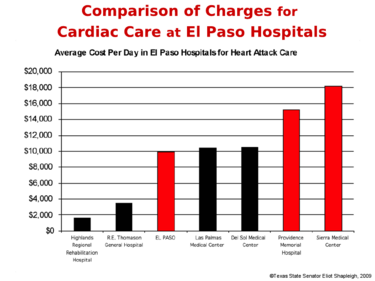

Overcharging and overutilization of services form the bases for some of the highest health care costs in the nation. Sierra Medical Center and Providence Memorial Hospital of El Paso are two of the leading profit centers in the entire U.S.. In fact, the three most expensive hospitals in Texas are Brownsville Medical Center, Sierra Medical Center in El Paso, and Providence Memorial Hospital in El Paso. They were ranked as the #8, #37 and #46 most expensive hospitals in America. All three are owned by Tenet Healthcare Corporation.

Half a century ago, El Paso boasted several not-for-profit hospitals, including Hotel Dieu and Providence Memorial Hospital (prior to its sale to Tenet in 1995). At that time, the great majority of hospitals were run by charitable organizations or public entities. In addition to the altruistic and often religious motive, patient care was at the heart of hospital dollars in El Paso. 60 years later, nearly all of the inpatient hospital beds available in El Paso are run by for-profit corporations. Now, profit lies at the heart of the private health care delivery system.

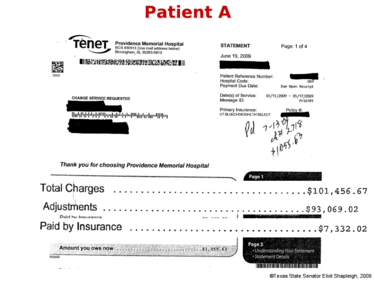

An El Paso citizen, who was experiencing chest pains ("Patient A"), was admitted to Providence Memorial Hospital last summer. It turned out that Patient A was not having a heart attack, and therefore, surgery or any other major procedure was not necessary. In fact, the only procedure performed was an angioplasty and Patient A was released within two days without any incident. A short time later, to his dismay, Patient A received a statement from Providence Memorial Hospital for $101,456.67. The only thing more shocking than the amounts that Providence Memorial had charged for a relatively minor procedure was how much the hospital adjusted the charges for Patient A's insurance company, Blue Cross Blue Shield of Texas. The insurance company paid $7,332.02—about 7 percent of what Patient A had initially been charged.

Unfortunately, Patient A's experience is not unique; it merely shows why medical costs are out of control in America.

Texas (and El Paso in particular) stands to benefit more than any other state in the U.S. from health care reform that decreases the number of uninsured, reduces medical costs, and makes businesses more competitive. Both of the bills passed by the U.S. House of Representatives in November and the U.S. Senate in December will dramatically reduce the number of people without health insurance; more than 30 million Americans would gain coverage. H.R. 3200 is estimated to reduce the national uninsured rate from 15 percent to less than 3 percent. That means health coverage for about 5 million Texans who do not have health insurance today.

Key Provisions of the Bills Passed by the U.S. House and Senate

| U.S. House of Representatives | U.S. Senate |

Individual Mandate | Includes mandate. Penalty: Tax equal to 2.5 percent of adjusted gross income over certain thresholds ($9,350 for individuals, $18,700 for couples). Exemptions: American Indians, people with religious objections and people who can show financial hardship. | Includes mandate. No penalty if the cost of cheapest available plan exceeds 8 percent of household income. Penalty: $95 a year or 0.5 percent of a household’s income, whichever is greater, in 2014; $495 or 1 percent of income in 2015; $750 or 2 percent of income in 2016 (with a maximum of $2,250 for a family). The penalty would be adjusted for inflation after 2016. Exemptions: American Indians, people with religious objections, people who can show financial hardship and people with income below 100 percent of the poverty level ($22,050 for a family of four). |

Regulation of Insurance Industry

| Prohibit insurers from denying coverage or charging higher premiums because of a person’s medical history or health condition.

Premiums for older people cannot be more than double the premium for young adults.

The legislation would strip health insurance companies of their antitrust exemption. It would outlaw price fixing, bid rigging and “market allocations” by companies that sell health insurance or medical malpractice insurance. | Prohibit insurers from denying coverage or charging higher premiums because of a person’s medical history or health condition.

Premiums for older people cannot be more than three times the premium for young adults.

The legislation would not strip health insurance companies of their longstanding exemption from federal antitrust laws.

Insurers would be immediately prohibited from excluding coverage of pre-existing conditions for children.

Insurers competing in the new exchanges would be required to justify rate increases and those who raise prices excessively could be barred from the exchanges.

Insurers would be required to spend more of their premium revenues — between 80 to 85 cents of every dollar — on medical claims. According to a recent Senate Commerce Committee analysis, the largest for-profit insurance companies spend about 74 cents out of every dollar on medical care in the individual market. |

Dependent Coverage | Allow children to stay on their parents’ insurance plans through age 26. Currently, states set the age at which adults can no longer be covered by their parents’ insurance. | Allow children to stay on their parents’ insurance plans through age 25. |

Subsidies for Individuals | Available to people with incomes up to 400 percent of the federal poverty level ($88,200 for a family of four). | Available to people with incomes up to 400 percent of the federal poverty level.

People who are covered through their employers and spend between 8 and 9.8 percent of their total income for premiums could buy insurance through the new exchanges with their employer’s money. Employers can convert their contribution to employee health coverage into vouchers.

The federal government would provide $25 million a year for a “pregnancy assistance fund.” The money could be used for “maternity and baby clothing, baby food, baby furniture and similar items." |

Insurance Exchange | Would create a national insurance exchange. States could operate their own exchanges, with federal approval.

Open to people who do not have qualifying coverage through an employer or a public program.

Open to employers with 25 or fewer employees in the first year, 50 or fewer in the second year and 100 or fewer in the third year. The exchange could be expanded to larger employers over time, “with the goal of allowing all employers access.”

Until the exchange is established, a temporary program would provide coverage to “those who have been uninsured for several months or denied a policy because of pre?existing conditions.” | States would form their own exchanges. Several states could join together to form a regional exchange.

Open to people who do not have qualifying coverage through an employer or a public program.

Open to employers with 100 or fewer workers, but states could allow employers with 50 or fewer workers to participate until 2016. Starting in 2017, states could allow employers with more than 100 employees to participate in the exchange. |

Public Plan | Public plan would negotiate payment rates with doctors and hospitals (rather than using Medicare rates set by the government).

The government would allocate $2 billion in start-up money, but beneficiary premiums would have to cover the full cost of the plan. The government would also provide loans to start nonprofit insurance cooperatives. | Would not create a public plan. The federal Office of Personnel Management, which provides health benefits to federal employees, would sign contracts with insurers to offer at least two national health plans to individuals, families and small businesses. The new plans would be separate from the program for federal employees, and premiums would be calculated separately. At least one of the plans would have to operate on a nonprofit basis. |

Employer Contribution | Would require most employers (those with annual payrolls of $500,000+) to provide insurance to workers or pay a tax. Employers with payrolls of $500,000 to $750,000 would pay a tax of 2 to 6 percent of wages, and those with payrolls above $750,000 would pay the full 8 percent tax.

Employers would have to contribute at least 72.5 percent of the premium cost for individuals and 65 percent for families for the lowest-cost plan that meets the minimum benefit requirements set by the government. | Would not explicitly require employers to offer coverage. But a company with 50 or more full-time workers would pay a penalty ($750 for each worker in the firm) if it does not offer health benefits and if any of the workers obtain subsidized coverage through the new health insurance exchanges.

Employers who offer coverage would be required to provide vouchers to low- and middle income workers to obtain insurance on their own through the exchanges. People with incomes up to 400 percent of the federal poverty level ($88,200 for a family of four) would be eligible for the vouchers if they spend between 8 and 9.8 percent of their income on premiums. |

Medicaid Expansion | Cover everyone with incomes less than 150 percent of the poverty level ($33,075 for a family of four).

Estimated number of new recipients: 15 million.

The federal government would pay all the costs for those who are newly eligible for the first two years and 91 percent of the costs after that. | Cover everyone with incomes less than 133 percent of the poverty level ($29,327 for a family of four).

Estimated number of new recipients: 14 million.

From 2014 to 2016, the federal government would pay all of the costs for covering the newly eligible. The share of federal spending would vary somewhat from year to year after 2016, but would average about 90 percent by 2019, according to the Congressional Budget Office. Currently, the federal government pays about 57 percent, on average, of the costs of Medicaid benefits. Nebraska is the only state that would receive 100 percent of the cost of expanding Medicaid. |

Illegal Immigrants | Would allow illegal immigrants to buy coverage from a national insurance exchange, but they would not get federal subsidies to help pay for it.

| Would not allow illegal immigrants to buy insurance from a national exchange, even if they could pay the full cost, without the subsidies. |

Paying for the Plan | Would impose a 5.4 percent surtax on high-income people — couples with adjusted gross incomes of more than $1 million a year and individuals over $500,000. Expected to raise $460 billion from 2011 to 2019.

A 2.5 percent excise tax on the medical devices sold for use in the United States. Expected to raise $20 billion from 2013 to 2019.

Squeeze $404 billion out of the projected growth in Medicare and other federal programs over 10 years, including $117 billion from cuts in Medicare Advantage plans. The government pays about 14 percent more for the private plans than it would pay for the same people in traditional Medicare. | Increase in the Medicare payroll tax rate — from 1.45 percent to 2.35 percent for individuals earning more than $200,000 a year and families earning more than $250,000. Expected to raise about $87 billion from 2010 to 2019.

A 40 percent excise tax on so-called Cadillac health plans — employer-sponsored group health plans with premiums over $8,500 for individual coverage and $23,000 for family. The bill would provide a special dispensation to police officers, firefighters, miners and construction workers, who have high premiums because they work in high-risk occupations. Expected to raise $149 billion from 2013 to 2019.

Annual fees, allocated by market share, on health care companies. Starting in 2011, drug makers would pay $2.3 billion a year. Manufacturers of medical devices would pay $2 billion in 2011 and $3 billion after 2017. For insurance companies, the fee would start at $2 billion in 2011 and gradually increase to $10 billion a year in 2017. Nonprofit insurance companies could be exempt if they spent a large share of their premiums on medical care rather than administrative costs. Expected to raise more than $100 billion from 2011 to 2019.

Squeeze $483 billion out of the projected growth in Medicare and other federal programs over 10 years, including $118 billion in cuts to federal subsidies for privately offered Medicare Advantage plans.

A 10 percent tax on indoor tanning services (replaces the 5 percent tax on elective cosmetic medical procedures that was originally proposed). |

Congressional Budget Office's Ten-year Cost Estimate | About $1.052 trillion. Expected to reduce deficits by $139 billion. | $871 billion. Expected to reduce projected federal budget deficits by $132 billion.

|

Total Coverage | 36 million people would gain coverage, leaving 18 million uninsured. | 31 million people would gain coverage, leaving 23 million uninsured. |

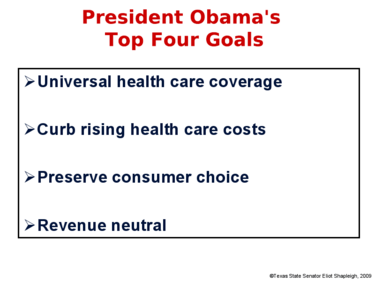

"socialized medicine"

In recent weeks, many have maligned health care reform efforts as a push towards "socialized medicine." Let's be clear. President Obama is NOT advocating for reform that would result in the government being the sole provider and payer of health care (like the British system and the U.S. Veterans Administration). Instead, the President's reform is focused on enhancing the current system of employer-subsidized health coverage coupled with private doctors and hospitals providing services. Individual citizens would be required to have health insurance, and they would be responsible for paying their premiums with assistance from their employers and/or government subsidies. This is the type of system found in many countries, including France, Germany and Switzerland. It's also how Medicare works in America.

Since its inception over four decades ago, Americans over the age of 65 yrs have relied on Medicare for health care. Almost all of the hospitals and doctors in the country participate in Medicare. In addition, Medicare's administrative expenses are 2 percent while private insurers carry administrative costs around 29 percent. And, as many have pointed out in recent weeks, no one considers Medicare "socialized medicine" or associates Medicare with rationing or bankruptcy.

"death panels?"

These accusations—of "death panels" and forced euthanasia—are absolutely not true. As an article from the Associated Press puts it: "No 'death panel' in health care bill." What's the real deal? Reform legislation includes a provision, which is supported by the AARP, to offer senior citizens access to a professional medical counselor who will provide them with information on preparing a living will and other issues facing older Americans. No one, including the government or your insurance company, will be given power to make life-and-death decisions for anyone regardless of their age. Those decisions will be made by you, your doctor and your family.

small businesses

In Texas, 87 percent of all employer firms have fewer than 20 employees. That's why the President made clear that small businesses with a payroll of less than $500,000 or fewer than 25 employees will be exempt from the requirement to offer health insurance. Small business owners who choose to offer health insurance to their employees will be eligible for significant tax credits of up to 50 percent of the costs of providing health insurance based on their size and payroll.

In all of the proposed bills, the smallest employers would gain quick access to new insurance exchanges where plans would compete for their business with rates comparable to those enjoyed by large employers. Today, small businesses in Texas pay 18 percent more on average than large businesses for the same benefits policy.

Finally, all across Texas, many small businesses with low-wage workers would be eligible for substantial tax credits to subsidize their coverage. All of the House and Senate bills under consideration offer subsidies for families up to 400 percent of the federal poverty level (up to $88,000 for a family of four). In El Paso, this would cover at least 80 percent of households.