SENATORS SHAPLEIGH, ELLIS AND DAVIS TO HOST PRESS CONFERENCE ON BILLS FILED THIS SESSION TO COMBAT PREDATORY LENDING IN TEXAS

March 23, 2009

“The time is now to restore transparency and fairness to Texas lending. For too long, predatory lenders have had their way with Texas. Lending reform will restore credibility to markets and move us faster to real recovery,” Senator Shapleigh said. "The root cause of today's financial meltdown is a mix of toxic mortgages? until this basic toxic transaction is fixed, recovery in the financial sector will be slow."

Written by Senator Eliot Shapleigh, www.shapleigh.org

AUSTIN - On Monday, March 23, 2009 at 11 a.m. CST in the Capitol Building's Senate Press Room in Austin, Senator Eliot Shapleigh (D- El Paso), Senator Rodney Ellis (D- Houston) and Senator Wendy Davis (D- Fort Worth) will host a press conference to outline bills filed this session to combat predatory lending in Texas.

Subprime mortgages, payday loans and refund anticipation loans (RALs) have come under fire from consumer advocates, federal regulators, and the U.S. military for trapping consumers into debts they cannot pay off. Very often these loans are a last resort for Texans struggling to provide for their families. With the Texas economy following the rest of the nation into recession, there is concern that demand for these predatory loans will increase.

The Dallas Branch of the Federal Reserve Bank estimated that Texas could lose as much as 300,000 jobs.

“The time is now to restore transparency and fairness to Texas lending. For too long, predatory lenders have had their way with Texas. Lending reform will restore credibility to markets and move us faster to real recovery,” Senator Shapleigh said. "The root cause of today's financial meltdown is a mix of toxic mortgages? until this basic toxic transaction is fixed, recovery in the financial sector will be slow."

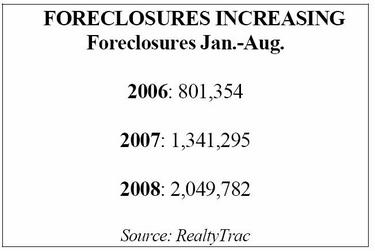

Rising default rates on subprime mortgages and falling home prices led to the credit crisis that crippled Wall Street beginning in 2007. Although the federal government has spent billions of dollars bailing out financial institutions, the economy continues to follow the housing market into decline. Across the U.S., more than two million homes went into foreclosure in 2008, and analysts at the Mortgage Bankers Association are predicting a record four million foreclosures in 2009. Housing prices have already fallen 25 percent nationwide since 2006.

The map below shows the number of high-rate loans issued in 2006, the driving force behind the current foreclosure crisis:

Click here to view larger image.

As the following chart illustrates, a surge in families seeking housing aid or shelter has followed rising home foreclosures nationwide:

Click here to view larger image.

The real estate research firm First American CoreLogic reported in October that “at least 7.5 million Americans owe more on their mortgages than their homes are currently worth.” Another 2.1 million own homes that are “worth less than 5 percent more than the mortgages they're paying on them.”

In October 2007, Senator Shapleigh wrote to Governor Perry alerting him to a crisis in the subprime mortgage market in Texas. In that letter, he asked the Governor to call a special session in early 2008 so that the Legislature could take action to protect Texas from anticipated revenue deficits from the projected recession.

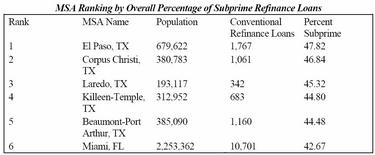

In Texas, predatory subprime loans are responsible for many of the more than 96,000 homeowners who lost their homes to foreclosure in 2008 and one out of every 35 Texas homeowners will likely face foreclosure by the end of 2010, according to the Pew Charitable Trusts. In Texas, 34 percent of all loans made in 2005-2006 were subprime.

Click here to view larger image.

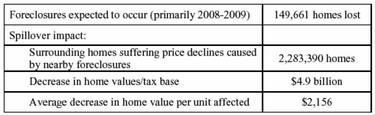

Affected homeowners are expected to lose $2,156 on average in property values and $4.9 billion is projected to be lost from the combined state and local tax base, as the chart below illustrates:

Click here to view larger image.

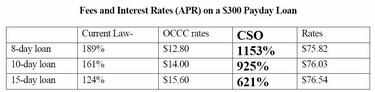

Payday loans are short-term loans with annualized interest rates that range from 300 to 1,000 percent annual percentage rate (APR). Payday lenders used to operate through the “rent-a-bank” or “rent-a-charter” model, in which they served as brokers for out-of-state banks to make loans to consumers. This scheme enabled Texas payday lenders to avoid state usury limits and rate limits established by the Office of Consumer Credit Commissioner (OCCC).

The Federal Deposit Insurance Commission (FDIC) disallowed this practice in 2005, prompting nearly all payday lenders in Texas to register as Credit Services Organizations (CSOs). This move enabled payday lenders to no longer be subject to Texas’ small loan law or regulation by the OCCC, and enabled some lenders to turn in their OCCC licenses. As a result, payday lenders were no longer obligated to submit data to OCCC and no longer subject to rates set by the OCCC.

Payday loans routinely charge interest rates in excess of 500 percent APR. The following chart illustrates the fees and interest rates that are often paid on a $300 payday loan:

Click here to view larger image.

In Texas today, nearly 400 CSOs ? payday, auto title and other lenders ? operate more than 2,000 storefronts, up from less than 100 CSOs in 2005. Because payday lenders operating as CSOs are no longer obligated to submit data to OCCC, Texas regulators have no official data regarding an industry that conducts more than two million transactions topping $1 billion per year.

Click here to view larger image.

Refund anticipation loans (RALs) are short-term, high cost loans secured and repaid by an individual's tax refund from the IRS. The APR for RALs range from 70 to 700 percent after fees. Tax preparers and RAL lenders, however, rarely report this true rate to consumers, but rather only report a much lower rate that excludes fees.

RALs erode the benefits of the Earned Income Tax Credit (EITC) for working Texans. The EITC is a refundable federal tax credit for low- and modest-income workers. Recent estimates show that the EITC lifted 4.4 million low-income Americans out of poverty—including 2.4 million children. According to a recent report by the Children's Defense Fund, however, in tax year 2006, low-income families lost $3.1 billion of their EITC benefits to RALs and other financial products issued by commercial tax preparers for "assisting" taxpayers in claiming benefits they already earned.

Tax preparers offering RALs engage in aggressive and often misleading advertising campaigns during tax season. In truth, consumers can often receive their IRS refund in as little as 10 days without utilizing these high cost, high risk loans. In many cases, consumers are not even aware that they have taken out a loan.

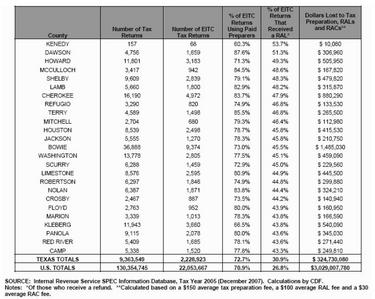

This chart shows Texas counties with the percentage of RALs purchases:

Click here to view larger image.

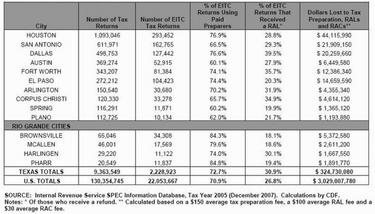

This chart shows Texas cities with the highest percentage of RALs purchases:

Click here to view larger image.

During the press conference, the senators will highlight the following bills filed this session to combat predatory lenders:

SB 1284: This omnibus mortgage reform bill provides the following protections for Texas homeowners, which are basic reforms already passed in many states:

· prohibits pre-payment penalties for subprime loans;

· prohibits flipping of a loan by a lender, meaning they cannot refinancing a loan that provides no tangible net benefit to the consumer;

· prohibits negative amortization loans in which the principal continues to grow despite monthly payments from the borrower for subprime loans;

· prohibits lender financing of credit insurance;

· requires lenders to schedule a face-to-face or phone meetings with borrowers to provide restructuring options before sending a notice of default;

· require lenders to provide a notice to borrowers regarding any change in interest rate 120 days prior to an adjustment;

· adds loans from residential mortgage banks to the list of consumer contracts that must be translated into Spanish;

· increases the surety bond to $100,000 for finance lenders or brokers of residential mortgage loans;

· requires that notice of default to be sent to a housing counseling agency designated by the debtor; and

· requires lender to mail a homeowner's bill of rights specifying the process and setting forth the rights of the borrower regarding contracts with mortgage foreclosure consultants

SB 189: This bill, co-authored by Senator Davis, would establish a 36 percent interest rate cap on military borrowers and dependents. This bill mirrors recent federal legislation that became effective in October 2007 and ensures that state law enforcement is empowered to combat predatory lenders. This bill was passed by the Senate on March 17, 2009 and will move to the Texas House of Representatives for consideration.

SB 242: This bill, co-authored by Senator Davis, would require the OCCC to establish a database to which all payday lenders must submit the following information weekly:

· the amount of cash advanced under each transaction made, serviced, or brokered by the person during the preceding week;

· the amount of transactions made that were outstanding on the last day of the preceding week;

· the total number of transactions renewed during the preceding week;

· any alternative payment arrangements that the lender offered;

· the average monthly income of an individual to whom a cash advance is made under a deferred presentment transaction, if the person collects that information from individuals; and

· the total amount of interest, fees, or charges collected by the lender during the preceding week.

Under SB 242, the OCCC must compile this data into an annual report to the state legislature. The bill will also require that lenders become OCCC-certified.

SB 243: This bill, coauthored by Senator Davis, would make it explicitly clear that CSOs should not extend credit when they have a relationship with the lender. It would amend the state’s Finance Code to prohibit CSOs from facilitating credit to consumers if they are affiliated with the lender, collect fees on behalf of the lender or receive an economic interest in the loan revenue, among other prohibitions.

SB 244: This bill, co-authored by Senator Davis, would make CSOs subject to interest rates set by the OCCC.

SB 248: This bill, co-authored by Senator Davis, would limit annualized interest charges for all deferred presentment transactions to 36 percent APR, the same rate established for military families and their dependants through the Talent-Nelson Amendment of the National Defense Reauthorization Act.

SB 609: This bill would give borrowers in foreclosure 45-day notice to vacate property and outline possible remedies to escape foreclosure. Currently, mortgage lenders in Texas must give only 20 days notice before foreclosing property, one of the shortest notice periods in the United States.

SB 1518: This bill would regulate RALs and limit interest rates charged to 36 percent a year, including all fees associated with computation of interest.

For more information on predatory lending in Texas, please read "Texas Borderlands: Frontier of the Future" 2009 - Access to Capital and Credit.

The press conference will be held in the Senate Press Room, 2E.9 in the Capitol Building in Austin at 11 a.m.

What: Senators Eliot Shapleigh, Rodney Ellis and Wendy Davis to host a press conference to outline bills that they have filed this session to combat predatory lending in Texas.

When: Monday, March 23, 2009 at 11 a.m. CST

Where: Senate Press Room, 2E.9 in the Capitol Building in Austin

- End -