From The Senator's Desk. . .

February 25, 2010

Patient A

What about this town hall in Washington D.C.? How does health care work in El Paso, Texas? Let's take the case of Patient A.

Half a century ago, El Paso boasted several not-for-profit hospitals. In 1950, Hotel Dieu broke ground for a 270-bed hospital. In 1952, Providence Memorial Hospital opened its doors with 272 beds. In 1959, voters approved a 335-bed facility to be run by the hospital district (now known as University Medical Center).

Written by Senator Eliot Shapleigh, www.shapleigh.org

What about this town hall in Washington D.C.? How does health care work in El Paso, Texas? Let's take the case of Patient A.

Half a century ago, El Paso boasted several not-for-profit hospitals. In 1950, Hotel Dieu broke ground for a 270-bed hospital. In 1952, Providence Memorial Hospital opened its doors with 272 beds. In 1959, voters approved a 335-bed facility to be run by the hospital district (now known as University Medical Center). All three were not-for-profit or religious-based care dedicated to patient outcomes. In 1987, Hotel Dieu closed; and eight years later, the Board at Providence Memorial Hospital sold El Paso’s largest hospital to Tenet Healthcare Corporation (Tenet). Today, Providence Memorial Hospital (still owned by Tenet) has 508 beds and some of the highest hospital costs in the U.S..

60 years later, nearly all of the inpatient hospital beds available in El Paso are run by for-profit corporations. Now, profit lies at the heart of the private health care delivery system. Overcharging and overutilization of services form the bases for some of the highest health care costs in the nation. Sierra Medical Center and Providence Memorial Hospital—both owned by Tenet—are two of the leading profit centers in the entire U.S.. In fact, the three most expensive hospitals in Texas are Brownsville Medical Center, Sierra Medical Center in El Paso, and Providence Memorial Hospital in El Paso. They were ranked as the #8, #37 and #46 most expensive hospitals in America. All three are owned by Tenet.

What does this mean for El Paso? Let's look at an example. An El Paso citizen, who was experiencing chest pains ("Patient A"), was admitted to Providence Memorial Hospital earlier this summer. It turned out that Patient A was not having a heart attack, and therefore, surgery or any other major procedure was not necessary. In fact, the only procedure performed was an angioplasty and Patient A was released within two days without any incident.

A short time later, to his dismay, Patient A received a statement from Providence Memorial Hospital for $101,456.67. The only thing more shocking than the amounts that Providence Memorial had charged for a relatively minor procedure was how much the hospital adjusted the charges for Patient A's insurance company, Blue Cross Blue Shield of Texas. The insurance company paid $7,332.02—about 7 percent of what Patient A had initially been charged.

Unfortunately, Patient A's experience is not unique; it merely shows why medical costs are out of control in America.

Here's another example of Tenet's true motivation. In June 2006, the Department of Justice reached a settlement with Tenet Healthcare Corporation ("Tenet") to pay the U.S. more than $900 million to resolve False Claims Act allegations related to Medicare fraud. Of the $900 million settlement amount, the agreement requires Tenet to pay:

- more than $788 million to resolve claims arising from Tenet’s receipt of excessive “outlier” payments (payments that are intended to be limited to situations involving extraordinarily costly episodes of care) resulting from the hospitals inflating their charges substantially in excess of any increase in the costs associated with patient care and billing for services and supplies not provided to patients;

- more than $47 million to resolve claims that Tenet paid kickbacks to physicians to get Medicare patients referred to its facilities, and that Tenet billed Medicare for services that were ordered or referred by physicians with whom Tenet had an improper financial relationship; and,

- more than $46 million to resolve claims that Tenet engaged in “upcoding,” which refers to situations where diagnosis codes that Tenet is unable to support or that were otherwise improper were assigned to patient records in order to increase reimbursement to Tenet hospitals.

Until last month, this $900 million settlement was the largest False Claims Act in the country (Pfizer reached $1 billion settlement in September of 2009). The chart below is a more complete listing of Tenet's civil and criminal cases.

1994 | Tenet (formerly National Medical Enterprises) $379 million | NME agreed to pay $379 million in criminal fines, civil damages, and penalties for kickbacks and fraud at NME psychiatric and substance abuse hospitals in more than 30 states. Of this amount, $33 million will be paid in criminal fines. After this settlement, NME renamed itself Tenet. |

2002 | Tenet $17 million False Claims Act violations | “One hundred thirty-nine hospitals currently or formerly operated by Tenet Healthcare Corporation will pay the United States and 22 states $17 million to settle allegations that the facilities overcharged federal health care programs in connection with laboratory services." |

2003 | Tenet $54 million Unnecessary cardiac procedures. Tenet also paid out hundreds of millions to private litigants. | “Tenet Healthcare Corporation will pay $54 million to settle allegations that it billed the federal government for unnecessary cardiac procedures and surgeries the Redding Medical Center in California. The settlement represents the largest recovery in the history of the United States Department of Justice in a case alleging lack of medical necessity, so-called ‘medical necessity fraud,’ which include cases involving allegations of unnecessary procedures, tests, lab studies, surgeries and similar conduct. |

2004 | Tenet $30.5 million | Santa Barbara-based Tenet Healthcare Corp. has reached a settlement worth $30.75 million with the U.S. Department of Justice, as well as some civilian lawsuits. The settlement resolved an inquiry by the Department into the hiring practices of a Tenet-run hospital in Florida, as well as a more generalized scrutiny of the company itself. The majority of the settlement, $22.5 million is going towards the investigation of the Florida hospital, which was under investigation because of its contracts with some of its physicians, as well as other issues. The rest will go to settle the civilian claims, all of which were filed due to problems with Medicare claims. As well as paying the money, the Florida hospital will have to meet the terms of a corporate integrity agreement, which will force it to abide by federal laws and regulations. Tenet is the second-largest hospital company in the U.S. (Mar-26-04 [LA BUSINESS JOURNAL] |

2005 | Tenet $6.5 million Additional payments for Redding cardiac case | See 2003 Redding case above. See also, http://www.uow.edu.au/~bmartin/dissent/documents/health/tenet_reddingupdate.html |

2006 | Tenet $7 million Medicare/Medicaid over-billing issues | Tenet Healthcare Corp. has agreed to pay $7 million to settle all charges brought by the Florida attorney general. Tenet Healthcare Corp. The Florida attorney general filed charges against the hospital chain for allegedly over billing Medicare and Medicaid. The lawsuit claimed Tenet violated racketeering laws by inflating profits in the federal elderly Medicare health program and over billed Medicaid, the federal health insurance program for the poor. (Feb-21-06) [CNN MONEY] |

2006 | Tenet $21 million Violation of anti-kickback laws | The company agreed to a civil settlement that includes a payment of $21 million to resolve potential civil claims by the government. The San Diego U.S. Attorney filed charges against the hospital chain for allegedly violating criminal anti-kickback laws by funneling more than $10 million to physicians to increase admissions at its Alvarado Hospital Medical Center. The lawsuit claimed Tenet bribed practitioners to established physician groups to entice them to admit patients to the hospital. (May-17-06) [ LOS ANGELES TIMES ] |

2006 | Tenet $900 million settlement for overbilling Medicare | “In July 2006, Tenet Healthcare agreed to pay the Federal Government $900 million for billing violations that include manipulation of outlier payments to Medicare, as well as kickbacks, up-coding, and bill padding. The DOJ press release notes that the settlement was based on the company's ability to pay…. Concluded a large civil and criminal investigation over Medicare outlier payments and questionable payments to physicians. Company also forced to sell 11 hospitals and enter into an integrity practice agreement”. See also, Tenet news release of June 29, 2006. |

2006 | Tenet $215 million Securities case | Shareholders filed a class action lawsuit against the hospital chain alleging securities fraud. Cases were filed in the U.S. District Court in Los Angeles and California Superior Court in Santa Barbara by those who purchased Tenet securities between January 11, 2000 and November 7, 2002. Tenet has agreed to pay a $215 million cash class action settlement to investors. (Jan-12-06) [HOUSTON CHRONICLE] |

2008 | Tenet $62.5 million False Claims Act violations | Tenet Healthcare, Redding CA. |

2008 | Lifemark (subsidiary of Tenet) $29 million False Claims Act violations | “Tenet Healthcare Corporation subsidiary Lifemark Hospitals of Florida has paid the United States $29 million to settle allegations that Lifemark, Tenet and various affiliated and predecessor companies violated the False Claims Act in connection with false claims submitted to the Medicare Program." |

2009 | Tenet $85 million Failure to pay employees for overtime | http://www.lawyersandsettlements.com/features/overtime-pay-laws-rules-employment.html |

|

|

|

Source: The Top 100 False Claims Act Settlements, Corporate Crime Reporter, Dec. 30, 2003, available at: http://www.corporatecrimereporter.com/fraudrep.pdf and http://www.taf.org/top100fca.htm.

As U.S. Senator Chuck Grassley (R-Iowa), then Chairman of the U.S. Senate Finance Committee, aptly stated, "Tenet appears to be a corporation that is ethically and morally bankrupt." Here is an excerpt from a letter addressed to Tenet dated September 5, 2003:

In the annals of corporate fraud, Tenet (formerly National Medical Enterprises (NME)) more than holds its own among the worst corporate wrongdoers. When Mr. Jeffrey Barbakow became president and chief executive of NME in 1993, NME was a scandal-plagued corporation accused of, among other allegations: maintaining a corporate policy at its psychiatric facilities of paying doctors for patient referrals; imprisoning patients for insurance payments; charging insurance companies for treatment and medication that were not provided, provided at grossly inflated prices or provided when unnecessary; and milking insurance until coverage was exhausted. After NME settled a wide-ranging federal investigation in 1994, for a then record $379 million healthcare fraud settlement, including $33 million in criminal fines, Mr. Barbakow, who had been an outside director for NME since 1990, stated that NME’s problems were worse than they seemed when he became CEO (prior to his stint as an outside director, Mr. Barbakow helped finance NME’s growth for more than a decade as an investment banker for Merrill Lynch).

After taking the reins of the corporation, Mr. Barbakow settled myriad allegations against NME, by agreeing to pay more than $600 million in legal settlements, and agreeing to plead guilty to several felony offenses, including charges of kickbacks, bribes, unnecessary medical treatments and false billings, at its psychiatric hospitals in 30 states. In addition, NME agreed to divest itself of its psychiatric facilities and agreed to a mandatory corporate integrity agreement (CIA) that required NME to implement a program designed to insure integrity in its relations with the government and the quality of care it provided. Finally, in 1995, NME changed its name to Tenet Healthcare Corporation after merging with American Medical Holdings, Inc.

Unfortunately, a change of names did not change the culture of fraud at the corporation. If anything, Tenet’s history of defrauding government healthcare programs reached new heights under Mr. Barbakow. The NME management team that agreed to the record $379 million settlement in 1994, including Mr. Barbakow, Ms. Christi R. Sulzbach, and four out of ten members of the Board, remained largely intact after the name change to Tenet. Ms. Sulzbach, who signed the settlement and CIA with the Department of Justice (DOJ), was promoted and became Tenet’s chief corporate officer, general counsel and chief compliance officer. According to the Department of Health and Human Services (HHS), Office of Inspector General (OIG), Tenet did not stay on the straight and narrow and has been the subject of at least 53 federal investigations dating back to the 1994 CIA, including among others, allegations of cost report fraud, upcoding, overbilling, duplicate billing, kickbacks, providing medically unnecessary services, misrepresenting services, falsifying medical records, billing for services not rendered, providing poor quality of care, and for patient abuse. Tenet has paid over $500 million to settle many of these investigations...

The $54 million settlement, as well as Tenet’s failure to acknowledge any liability or wrongdoing, is further evidence, in my opinion, that Tenet views healthcare fraud settlements as the cost of doing business with the federal government, while profiting at the expense of innocent victims and America’s taxpayers. It is long past due that Tenet, and its officers, directors and board members, be held accountable for the corporate culture and governance practices that resulted in healthcare settlements totaling over a billion dollars in the past decade.

And as many of you might remember, Tenet spent hundreds of thousands of dollars trying to kill our new Children's Hospital, another "public option." Upon review of reported political contributions and expenditures, Tenet spent at least $285,194.21 to oppose the Children’s Hospital Bond in 2007—this figure does not include the thousands of dollars Tenet spent to advertise their children's wing as "The Children's Hospital at Providence."

Total Political Expenditures in Opposition of Children's Hospital Bond

| Reported Political Expenditures: Oct. 2007 | Reported Political Expenditures: Nov. 2007 | Reported Political Expenditures: Dec. 2007 | Reported Political Expenditures by Jan.2008 | Total Political Expenditures |

Tenet Healthcare Corporation | $86,646.29 | $100,000* | $98,547.92 | — | $285,194.21 |

Texans for Fiscal Responsibility | $43,856.269

(received $43,860 political contribution from Empower Texas) | — | — | $44,970

+ $55.030 in reimbursement payments to Empower Texas

= $100,000 | $143,856.29 |

Luis A. Ayo, M.D. | $7.668.81 | — | — | — | $7.668.81 |

*Political Contribution by Tenet to Texans for Fiscal Responsibility as reported by TFR in their campaign finance report.

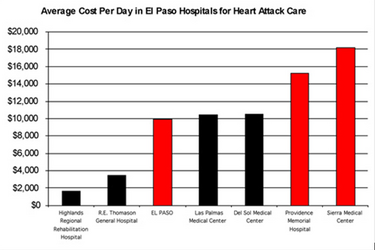

Let's look at some other numbers. As the chart below shows, the average cost of cardiac care at Providence Memorial Hospital is more than $15,000 per day, and at Sierra Medical Center, it's more than $18,000 per day. At R.E. Thomason General Hospital (now known as University Medical Center of El Paso)—the "public option"—it's less than $4,000 per day.

Click here to view larger image.

In other words, these Tenet-owned hospitals charge about four times what the public hospital charges. To protect these profit margins, Tenet spent hundreds of thousands of dollars to try to kill the Children's Hospital bond. And this is why a licensed not-for-profit Children's Hospital will deliver so much more value for your dollar.

Here in El Paso, in so many ways the frontier of the future, our citizens experience daily the hundred reasons why we need health reform now. One in three in El Paso has no health insurance. We have fewer doctors per capita here than in any large city in America. High health costs are redistributed among those who can least afford it.

From the mother in Montana Vista who drives forty miles round trip to have her son’s broken arm set to the single mom with two children who has health insurance, but it’s not enough—so she is now in Chapter 13, paying what she can over time. From the state representative, who gets an appendectomy in Juarez because he bought a "bare bones" policy to the middle aged professional who changes jobs but must leave his health coverage behind.

El Paso needs reform now.

![]()

![]()

Related Stories