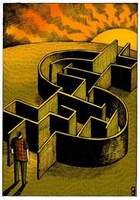

The debt trap of payday loans

February 11, 2010

Karen Young from Lawrenceburg borrowed less than $200 from a payday lender to cover her musician husband’s transportation expenses. She repaid it in two weeks but it didn’t stop there. She still needed cash. She wrote a new check to take out a new loan. She got caught in a cycle.The cycle went on for 18 months. Payday loans didn’t help Karen hold off a crisis. They added to her debts.

Written by Amy Shir, The Courier-Journal

Karen Young from Lawrenceburg borrowed less than $200 from a payday lender to cover her musician husband’s transportation expenses. She repaid it in two weeks but it didn’t stop there. She still needed cash. She wrote a new check to take out a new loan. She got caught in a cycle.The cycle went on for 18 months. Payday loans didn’t help Karen hold off a crisis. They added to her debts.

In the end, Karen refinanced her home to pay off what she owed. Along the way, she paid almost 10 times the original payday loan in fees. Karen’s story is common. Loans are taken out back to back, over and over. The result is a “debt trap.”

This isn’t an aberration. It is the intentional business model on which the payday loan industry flourishes. “You’ve got to get that customer in, work to turn him into a repetitive customer, long-term customer, because that’s really where the profitability is,” said Dan Feehan, CEO of Cash America, a major payday lender.

The numbers nationally: $25 billion of $29 billion earned by the payday loan industry annually comes from loans taken out back to back. Kentuckians paid an estimated $158 million in fees in 2008. Kentucky payday loan borrowers use an average of nine loans per year and thereby pay an estimated $822 on a $350 loan — a whopping $472 in fees!

Solution

The Kentucky Coalition for Responsible Lending was formed to help Kentuckians like Karen. Our 64 member groups include faith-based and senior citizens groups, domestic violence programs helping women re-establish economic stability, youth advocates and more.

The solution we propose is the same as Congress already enacted for military families. Call the fees what they are — interest on a loan — and cap the annual interest rate at 36 percent.

Fifteen states and the District of Columbia cap payday loan rates — usually at 36 percent APR or less — or never allowed payday lending. (Ohio recently capped rates at 28 percent. West Virginia never allowed payday loans at all.)

There’s no reason that Kentucky families shouldn’t have the same protection. This year they might get it. Gov. Steve Beshear has endorsed the rate cap and Rep. Jim Glenn, D-Owensboro, has agreed to sponsor a bill.

Faith-based and senior groups

Why do our members care? The Bible is full of verses that prohibit taking advantage of the poor, and it specifically forbids usury (Exodus 22:25). Those teachings matter to our faith-based members.

When it comes to seniors, AARP reports that payday lenders increasingly target the elderly and people with disabilities. (The monthly cycle of Social Security and SSI disability checks fits the “business model” of repeat loans.)

A study commissioned by The Wall Street Journal found that payday loan stores cluster around government-subsidized housing for seniors and people with disabilities. Our coalition soon will publish a study with maps showing where the stores are located, with county data on the burden of debt.

Obstacles

Payday lenders lobbied vigorously in 1998 for the Kentucky law that lets them operate here — and exempts them from interest rate limits of other lenders. We expect they will oppose the 36 percent cap. They may also point to last year’s bill to establish a “database” of payday loans as a reason not to do more.

We disagree. The database is simply a tool to enforce the current limits of two loans totaling $500 at a time. It will not cut the costs of loans. Studies from other states show it will not break the cycle of debt.

Now is the time

Thousands of Kentuckians are losing jobs, filing for bankruptcy or facing foreclosure on their homes. One toxic product shows up amidst much of this suffering: payday loans. The General Assembly can make a real difference by enacting a proven solution. We encourage all Kentuckians to call your state legislators today at 1-800-372-7181. Ask them to enact the 36 percent rate cap on payday loans.

![]()

![]()

Related Stories

![]()

Fair Use Notice

This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a "fair use" of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml. If you wish to use copyrighted material from this site for purposes of your own that go beyond "fair use", you must obtain permission from the copyright owner.