Raise Your Hand If You Believe Texas' Tax System is Fair

March 24, 2005

This is slide six of Senator Shapleigh's explanation of the top 10 slides in his "A New Texas: Invest in Texas, Invest in Our Future" school finance presentation.

Written by Senator Eliot Shapleigh,

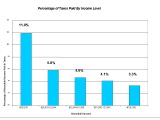

One of the major sources for the belief that Texas' tax system is not fair is the perception that high-income people are not paying their fair share of the overall tax burden. An equitable tax system distributes the tax burden according to the ability of each taxpayer to bear that burden. A tax system that takes a larger share of the income of lower-income taxpayers is considered a "regressive" system. Texas' tax system is regressive, primarily because it relies so heavily on the sales tax. Lower-income taxpayers spend a larger proportion of their income on necessities than higher-income taxpayers. As the chart above shows, the result is that the poorer a person is in Texas, the greater the percentage of her income that is paid to support the government. In fact, it was the regressive nature of our tax system and the accompanying perception of unfairness that prompted the state legislature to create the sales tax-exempt back-to-school holiday. When formulating tax policy in Texas, we need to ensure that everyone contributes to the burden and enjoys the benefits of a fair, balanced tax system.

![]()

![]()

Related Stories