Equal Funding for an Equal Tax Effort

February 3, 2005

This is slide three of Senator Shapleigh's explanation of the top 10 slides in his "A New Texas: Invest in Texas, Invest in Our Future" school finance presentation.

Written by Senator Eliot Shapleigh,

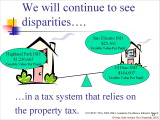

Different communities across Texas can raise vastly different amounts to support their local public schools because the value of property varies so much across the state. The diagram above shows the taxable value per pupil for three communities in Texas. A taxable value of $1,236,665 means that the Highland Park community will raise $124.00 per student for each penny of tax effort; El Paso ISD can only raise $14.46 per student and San Elizario only $2.52. While a penny of tax effort in Highland Park will buy each of their students a software program, San Elizario can hardly buy a student his lunch with the same penny of tax effort. The Robin Hood system helps ensure that every community in this state willing to make the tax effort to have excellent public schools has the same ability to do so as any other community willing to make the same effort. The current system guarantees equal funding for equal tax effort, regardless of local property wealth.

If the Robin Hood system is replaced with one that limits state aid, but allows communities to fund their local schools with extra money raised only from the local tax base, only the richer communities will be able to afford to enrich their schools.

![]()

![]()

Related Stories