Letter to Dewhurst

March 4, 2010

Below you will find a letter to Lieutenant Governor Dewhurst regarding the recent proposals to swap the property tax and dramatically increase the sales tax:

Written by Senator Eliot Shapleigh, www.shapleigh.org

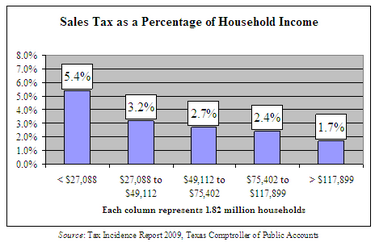

March 5, 2010 The Honorable David Dewhurst Texas Lieutenant Governor Texas Capitol, Room 2E.13 Austin, Texas 78701 VIA HAND DELIVERY RE: "Texas Tax Swaps" Dear Governor Dewhurst: I write regarding recent proposals to eliminate the property tax and dramatically increase the sales tax. Under other such "swap" proposals where property taxes were cut and consumption taxes were hiked, nine in ten Texans would have received a tax increase. Only one in ten—those making over $181,711—would have received a tax cut. At a time when Texas' richest families—the top five percent—have average incomes 13 times as large as the poorest 20 percent of families, this inequitable tax swap must be opposed. Here's why: 1. Few progressive taxes exist in Texas. This proposal swaps a flatter tax for an extremely regressive tax, thus making one of America's most regressive tax systems dramatically more regressive. As you know, the sales tax is a regressive tax that affects low- and middle-income families the most, as they spend a greater proportion of their limited incomes on items such as clothing and school supplies for their children in comparison to families with higher incomes. Texas already ranks a dismal 44th in the nation in the progressivity of its tax revenues, and increasing the regressive sales tax will only move our state further away from a fair and equitable tax system. The result of this regressive tax system is that a greater percentage of the incomes of low and middle-income families goes toward supporting our government. At the low end of the income scale, families spend 3.2 times more of their household income via sales taxes than families at the high end. Meanwhile, the property tax is almost a flat tax. The chart below illustrates our point:

2. Texas already relies too heavily on the sales tax and has one of America's most regressive tax systems.

The sales tax has produced the majority of state tax collections in Texas every year since 1988. During the 2010-11 biennium, the sales tax will comprise approximately 56 percent of state tax revenue. This dependency has pushed our sales tax rate to become one of the highest rates in the nation.

As the chart below shows, at 7.39 percent, Texas’ average combined state and local sales tax is the fifth highest rate amongst the ten most populous states.

Sales Tax Rates in the Ten Most Populous States, 2009

| State | State Rate | Average Local Rate | Combined Rate |

| 1. California | 8.25 | 0.81 | 9.06% |

| 2. Illinois | 6.25 | 2.15 | 8.40% |

| 3. New York | 4.00 | 4.30 | 8.30% |

| 4. North Carolina | 5.75 | 2.32 | 8.07% |

| 5. Texas | 6.25 | 1.14 | 7.39% |

| 6. Georgia | 4.00 | 3.02 | 7.02% |

| 7. Florida | 6.00 | 1.01 | 7.01% |

| 8. Ohio | 5.50 | 1.33 | 6.83% |

| 9. Pennsylvania | 6.00 | 0.22 | 6.22% |

| 10. Michigan | 6.00 | ---- | 6.00% |

3. Another "Texas tax swap" that shifts to the sales tax creates a greater tax burden for nine in ten Texans.

Because the sales tax is regressive, any increase will hit low- and middle-income Texas families the hardest. Let us review some hard numbers produced by the Legislative Budget Board. In H.B. 1 from the Fourth Called Special Session of the 78th Legislature, the House proposed a similar tax swap, in addition to other revenue-raising ideas, to increase the state sales tax rate to 6.75 percent in return for reducing school district property taxes to $1.05. The tax equity note, reproduced below, shows that only the wealthiest Texans—those with incomes over $181,711—would have experienced a tax cut, while the remaining 90 percent of Texans would have experienced a tax increase. Fortunately, the bill did not pass, but this bad idea comes back every session any time there is a deficit and will certainly make it into bills in the 82nd Legislative Session.

Tax Incidence by Income Decile: Current Law vs. HB 1, FY 2006

| Decile | Expanded Family Range (Dollars) | Current Law Tax (Millions) | CSHB 1Tax (Millions) | Change in Tax (Millions) | PercentChange in Tax | ||

| 1 | $0 | to | $15,398 | $2,241.9 | $2,348.1 | $106.2 | 4.74% |

| 2 | $15,398 | to | $28,652 | $2,569.0 | $2,709.7 | $140.7 | 5.48% |

| 3 | $28,652 | to | $42,154 | $2,895.1 | $3,031.9 | $136.8 | 4.73% |

| 4 | $42,154 | to | $56,464 | $3,587.2 | $3,781.0 | $193.8 | 5.40% |

| 5 | $56,464 | to | $71,066 | $3,936.9 | $4,136.1 | $199.2 | 5.06% |

| 6 | $71,066 | to | $87,605 | $4,472.4 | $4,670.4 | $198.0 | 4.43% |

| 7 | $87,605 | to | $107,794 | $5,196.2 | $5,371.6 | $175.4 | 3.38% |

| 8 | $107,794 | to | $135,001 | $5,962.7 | $6,088.4 | $125.7 | 2.11% |

| 9 | $135,001 | to | $181,711 | $7,796.5 | $7,878.9 | $82.4 | 1.06% |

| 10 | Over | to | $181,711 | $10,549.7 | $10,226.8 | ($322.9) | (3.06)% |

While the sales tax is currently deductible on federal income tax returns, only people who itemize their deductions are eligible to benefit. In 2006, the most recent year for which complete data is available, only 19.5 percent of Texas taxpayers utilized the itemized sales tax deduction. Furthermore, it was primarily the wealthy that benefited. Of the total amount of sales tax deductions, almost 54.8 percent was claimed by taxpayers with adjusted gross incomes of more than $100,000. On the other hand, only 14 percent of the total amount of sales tax deductions were claimed by those with adjusted gross incomes under $50,000—despite the fact that this group of taxpayers made up 70 percent of all Texas tax returns.

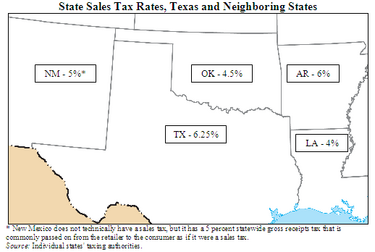

4. Increased sales taxes will put Texas businesses at a competitive disadvantage.

If Texas were to increase the sales tax rate, these costs would be passed along to both Texas consumers and consumers across the country and world, thus putting Texas goods at a severe competitive disadvantage. Further, Texans who live near the state border would have an incentive to travel to the neighboring state to access lower sales tax rates. The map below highlights the state's portion of the sales tax rate for New Mexico, Oklahoma, Arkansas, and Louisiana.

Click here to view larger image.

5. Texans do not want more sales taxes.

Using the sales tax to lower property taxes does not provide the relief that Texans need. Part of the reason is that middle-income Texas families already pay more in sales taxes than property taxes. A Texas household with an income between $49,112 and $75,402 per year—the middle quintile—pays more in sales taxes ($3,069) than property taxes ($2,750).

Texans want property tax relief for everyone, not tax breaks for a wealthy few and tax increases for everyone else. A poll conducted by Baselice & Associates between March 29 - April 5, 2004 demonstrates the sentiments of Texans on increasing the sales tax. When asked if they favored or opposed increasing the state sales tax rate, 69 percent of the respondents stated that they opposed a sales tax increase.

Similarly, a flyer delivered to our office last session listed a group of major Texas businesses and employers that, in their words, "do not support proposals that would allow local governments to take action resulting in a total local sales tax rate above the existing two percent cap." The businesses that signed are listed on the following page:

According to their flyer, here's why:

- "The current state and local rate of 8.25% already is among the highest in the country—a situation that would only be made worse by raising local tax rates.

- It would undermine the competitiveness of all businesses in the impacted areas by increasing their cost of doing business and would doubly impact retailers who also would face the prospect of reduced sales.

- Higher sales taxes will have a regressive impact on low to moderate income families that make purchases in the impacted areas."

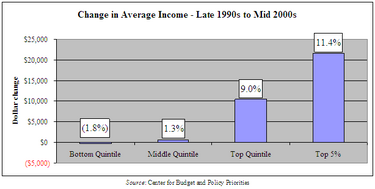

6. In Texas, the gap between the "haves" and the "have-nots" is large and growing; raising the sales tax and eliminating the property tax would hike taxes on middle and low income Texans and make Texas the leader in income inequality across America.

The gap between Texas’ wealthiest families and families in the middle is fifth largest in the nation, and the gap between Texas’ wealthiest and poorest families is ninth largest in the nation. Further expanding this income inequality between the "haves" and "have-nots" with a property/sales tax swap proposal that cuts taxes for the wealthiest Texans and hikes them for everyone else does not seem like a policy any majority of Texans could support.

Click here to view larger image.

If legislators want to debate the merits of reducing the property tax, that is fine. But hiking taxes on nine in ten Texans is no way to pay for it. This proposal offers only one choice—a more regressive, less fair option. Voters who vote their real pocketbook interests will learn the real impact of another Texas tax swap. Based on self-interest, nine in ten will reject this bad idea. If elected officials believe in voters, why not offer other options for voters to make an informed choice on a fair and better tax system?

Very truly yours,

Eliot Shapleigh

ES/de

Enclosures: Texas Comptroller, Tax Exemptions & Tax Incidence 2009

![]()

![]()

Related Stories