From the Senator's Desk . . .

November 12, 2009

“Money Talks”

When Jesus chased the money changers from the temple he was protecting the poor from usury—something prohibited by most of the world’s major religions. Since the founding of the Republic, Texas wrote this value into the Constitution with strict anti-usury laws. Then came Rick Perry and legions of predatory lenders.

Written by Senator Eliot Shapleigh, www.shapleigh.org

NAMES IN THE NEWS: BANK OF AMERICA

When Jesus chased the money changers from the temple he was protecting the poor from usury—something prohibited by most of the world’s major religions. Since the founding of the Republic, Texas wrote this value into the Constitution with strict anti-usury laws. Then came Rick Perry and legions of predatory lenders.

Here’s some history. Following the Texas revolution in 1836, the new Republic of Texas advertised in east coast papers to lure debtors here. As a new nation, on the frontier with Mexico, Sam Houston and others feared that Santa Ana might return, so young Texas did everything possible to lure debtors here—to settle, thrive and defend Texas.

Often, people fleeing crushing debt in other parts of the country would scrawl in chalk on the doors of their abandoned houses the initials G.T.T. for "Gone to Texas."

In fact, Texas' debtor protection laws have been among the most protective throughout U.S. history—that is, until Rick Perry made Texas the playpen for predatory lenders.

In 2007, the U.S. Congress passed a law restricting payday lenders from charging more than 36 percent interest to members of the active duty military or their families. Since then, seven state legislatures have attempted to expand the law, capping the interest rate at 36 percent for all citizens. According to the Center for Responsible Lending, fifteen states currently prohibit payday loans by capping interest rates to prevent prohibitive rates.

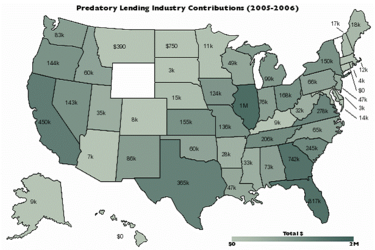

In 2003, nearly 50 bills relating to the predatory lending industry in 23 states were introduced. In 2007, 33 state legislatures introduced more than 100 bills. Payday lenders have countered these attempts by lawmakers across the country to increase regulation of predatory lending by upping their political giving. Since the 2000 election cycle, companies and associations representing the predatory financial services industry have contributed more than $10.2 million to state-level candidates and party committees in 41 states, and individuals associated with the predatory lending industry gave another $3.54 million in 45 states.

In Texas, the campaign contributions worked like a charm on Governor Rick Perry, who has actively thwarted any regulatory reform of the lending industry throughout his tenure. Thus, while scores of states have cracked down on predatory practices such as usury, prepayment penalties, fees and loan flipping, Texas has become a safe haven for the predators and a hot bed of predatory lending.

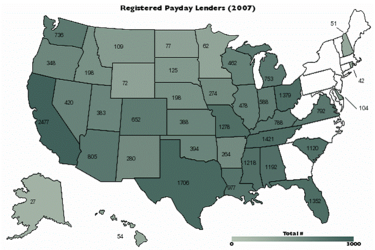

Payday lending, in particular, has flourished. Payday loans are short-term, high-cost loans secured with a check post-dated to payday. Payday loans trap consumers—borrowers are largely low-income, minority, or members of the military— in a cycle of debt that often leads to financial ruin. The explosion of this industry over the last 10 years offers a poignant illustration of Perry’s failure to protect Texas consumers.

Payday lenders have actively wooed Texas politicians in an effort to prevent greater regulation. Cash America, a Texas-based payday lender, made almost $825,000 in political contributions nationwide from 1999 to 2006. During this time period, Texas ranked 5th in the nation in total political contributions from the payday lending industry. The industry has given $715,982 since 2000, over half of which was donated in 2006:

Click here to view larger image.

While Texas law technically prevents payday lending, the Texas Legislature has maintained a loophole for predatory lenders that allows them to operate outside the law. Since 2005 most major payday lenders have used this loophole to brazenly ignore Texas usury laws.

As a result of this loophole, while the number of states that have banned payday lending continues to grow, in Texas the industry is flourishing.

Click here to view larger image.

Texas-based lenders now charge among the highest interest rates in the nation, with up to 1,150 percent APR routinely charged on payday loans:

Fees and Interest Rates (APR) on a $300 Payday Loan

|

| Current Law - OCCC rates | CSO rates | ||

| 8-day loan | 189% | $12.80 | 1153% | $75.82 |

| 10-day loan | 161% | $14.00 | 925% | $76.03 |

| 15-day loan | 124% | $15.60 | 621% | $76.5 |

Source for CSO rates: Cashnet (subsidiary of Cash America) http://www.cashnetusa.com/fee-schedule-texas.html

Source for OCCC rates: http://www.occc.state.tx.us/pages/int_rates/deferred%20presentment%20transaction%20rate%20charts%20.xls

The loophole scam works like this: a payday lender hands in its lending license and registers as a “Credit Services Organization” (CSO), which are not regulated under state law. Unregulated by the Office of Consumer Credit Commissioner (OCCC), CSOs can charge as much interest as they want—calling it “fees”—and consumers are defenseless. The state is powerless to enforce its usury laws, keep tabs on unscrupulous business practices, or even collect loan data. To keep Perry’s playpen free of regulation, he appointed the Vice President of "government relations" of Cash America as head of the Texas Finance Commission. That’s what Perry means when he says "open for business."

Astonishingly, payday loans cost Texas families annually nearly double what the state sets aside for financial aid to help Texas kids attend college. A recent study calculated the financial impact of predatory lending on Austin, Dallas, El Paso, Houston, Fort Worth, and San Antonio. In these cities alone, unregulated payday lenders lent $1.14 billion in 2006. Statewide, the total loan volume was at least $ 2 billion. To obtain these cash advances, working Texans paid at least $400 million in interest and fees, not to mention bank overdraft fees and credit costs ensuing from overzealous collection practices.

Seeing these abuses, for the past five sessions I successfully fought off industry-backed bills and filed legislation that would have closed the CSO Loophole. I also filed legislation that would have created a predatory lending database, and legislation that would have limited to 36% the interest rate charged to members of our military. The bills have been referred and re-referred to the Senate Committee on Business and Commerce and the State Affairs committee. For the past two sessions, the bills were referred to Business and Commerce, where they were held by Rick Perry’s boyhood friend, Troy Fraser, until it was too late in the session for them to pass. The committee never even had the opportunity to vote on the bills. Meanwhile, the score of lobbyists sitting in the back, paid with profits from predatory loans, emailed back to the predatory lenders who put them to work—that it was “time to renew their contracts.”

In Austin, money talks, and Perry listens.

![]()

WITH INTEREST PREDATORY FINANCIAL SERVICES INDUSTRY CONTRIBUTES TO STATE POLITICS

![]()

Download this document for more information.

![]()

![]()

Related Stories